AUTOMATIC has successfully executed 20 GST Migration Projects for our Indian Customers!!

The Goods and Services Tax (GST) is an indirect tax which was introduced in India from July 2017 and was applicable throughout India which replaced multiple cascading taxes levied by the Central and State Government. GST is considered as the reform of the century in India and is expected to streamline and substantially ease doing business in India. However, for this, the organizations need to first get this processes and systems organized and GST compliant.

With changing business requirements and statutory regulatory requirements keeping GST Migration in place, SAP provided SAP customers with newer notes and required system pre-requisites for the notes to be implemented.

SAP system upgrade and GST migration projects are complex activity and needs meticulous planning and professional project execution. Customers expects a minimum system downtime, a smooth transition and successful system upgrade and GST migration while making sure that the existing SAP system usage is not disturbed.

In July 2017, Automatic helped over mid-large size organizations to successfully deploy GST in their SAP systems.

Subsequently, after extensive research with customers and partners, Automatic has developed a comprehensive GST reporting package.

The GST reporting package solution enables customers to quickly deploy the most important reports in their SAP systems. Based on the customer’s special processes, business demands or GST/ASP partner relationship, Automatic’s consulting team can further help in streamlining the solution deployment in customer’s SAP eco-system.

Automatic has developed an Integration Solution (SAP Utility + Web Service Solution) to help in GSTR reporting. This can help in providing the data to the GSP providers, who will have to just forward the data to the GSTN portal. The RFC modules delivered by Automatic package read the required Sales / advance receipt data and call a Web Service which will transfer the data to the GSP portal. The report can also be executed online for data verification (and displays the data in GRID layout). Exported data is stored in a customer table for future references.

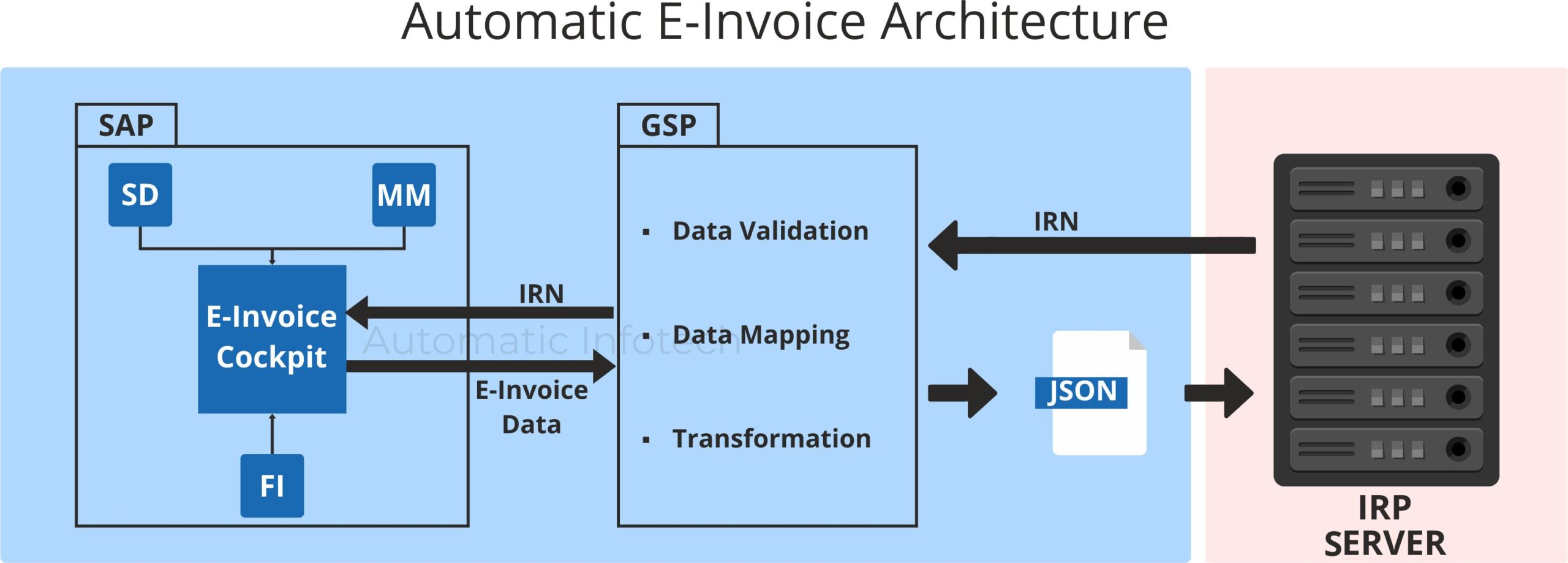

A bi-directional RFC enabled function allows you to extract the E-Invoice specific information from your SAP system and provide it to the GSP. Upon successful processing and generation of the IRN number, this information can be received back in the SAP system for assignment to the SAP Invoice document and for generation of the necessary QR codes for output.

In this section, we describe the functionalities and features of Automatic’s SAP GST Reporting cockpit.

Functional overview

The packaged solution provides following functionalities for the end customer:

- Cockpit Customization

Customer specific data / parameter mapping (for e.g. document types relevant for scenarios) - Data generation for GSTR reporting

Extraction of data from Sales, Purchase and Accounting billing documents of various types along with related information

E-Invoice Architecture

GSTR Reporting:

Data export to external / GSP systems through

- API Calling ( of GSP)

- Excel

- XML (Web-service enabled)

- JSON (Web-service enabled)

Transmission and processing LOGs

- Information about the validations (within SAP / at GSP) and the validation LOGs

e-Invoicing cockpit:

IRN generation

- Export of the generated invoice information (in the pre-defined format) to the external GSP / folder

- In case of GSP interface, receipt of the generated IRN and storage of IRN / QR code with reference to the invoice document in SAP

IRN cancellation

- Cancellation of E-Invoice

e-Way Bill Cockpit:

E Way Bill Number (EBN) generation

- Export of the generated Sales and Sub Contracting invoice information (in the pre-defined format) to the external GSP

- In case of GSP interface, receipt of the generated EBN and storage of EBN with reference to the invoice document in SAP

e-way bill functions

- Cancellation of E-Way Bill

- Updation of the E-WAY Bill

- Extension of the E-Way Bill

- Print out of the E-Way Bill

Contact us on sales@automaticinfotech.com to know more about our SAP GST Migration / Support services.